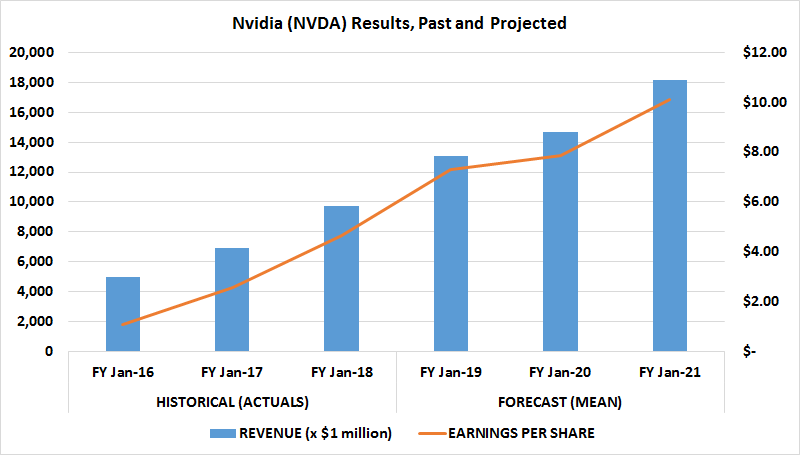

Some better-ranked stocks from the broader Computer and Technology sector are Clearfield ( CLFD Quick Quote CLFD - Free Report), Silicon Laboratories ( SLAB Quick Quote SLAB - Free Report) and Taiwan Semiconductor ( TSM Quick Quote TSM - Free Report). Shares of NVDA have decreased 42% year to date (“YTD”). NVIDIA currently carries a Zacks Rank #4 (Sell). NVIDIA projects to report revenues of $3.81 billion from the segment, indicating an increase of 61% on a year-over-year basis and 1% sequentially. However, the company stated that data center revenues might fall short of management’s expectations due to ongoing supply-chain disruptions. An increase in the Hyperscale demand and the growing adoption in the inference market are likely to have been tailwinds during the to-be-reported quarter. The continued strength of its data center business on the growing adoption of cloud-based solutions amid the pandemic-induced work-from-home wave is expected to have boosted NVDA’s second-quarter revenues.

The company anticipates reporting Gaming segment revenues of $2.04 billion, down 33% year over year and 44% sequentially. However, in its fiscal second-quarter preliminary results reported on Aug 8, NVIDIA stated that Gaming segment revenues would decline significantly in the second quarter, suggesting a reduction in channel partner sales due to macroeconomic headwinds. Moreover, with the massive emergence of multiplayer online games and Gaming-as-a-Service concepts, demand for graphic processing units shot up exponentially. The demand for NVIDIA’s gaming chips increased immensely as people were surfing games to stay engaged and entertained indoors during lockdowns. NVIDIA Corporation price-eps-surprise | NVIDIA Corporation Quote NVIDIA Corporation Price and EPS Surprise

0 kommentar(er)

0 kommentar(er)